The Rule of 72

The rule of 72 teaches that money can work for you or against you.

Albert Einstein said: “Compound interest is the greatest mathematical discovery of all time. It’s the eighth wonder of the world. He who understands it, earns it – he who doesn’t, pays it.”

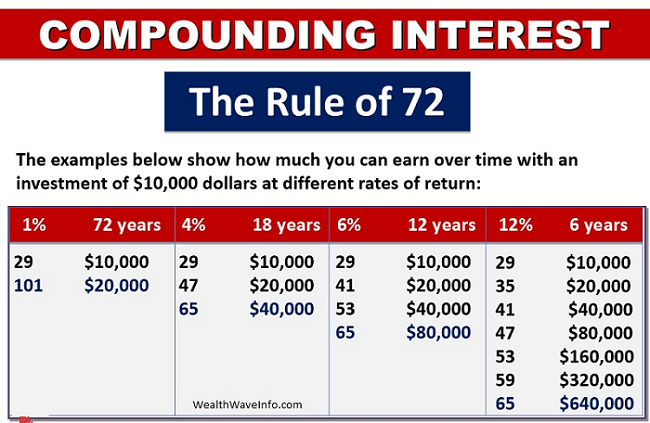

The rule of 72 states that if you divide the interest rate by 72 you will get approximately how long it will take for your money to double. When you save or invest, money can work for you. Let’s look at how this works and how your interest rate can make all the difference in what your return will be.

If on the day you were born your parents put $10,000 into a savings account, and that lump sum yielded a 1% fixed interest rate, you’d have around $20,000 waiting for you when you turned 72. If the interest rate was 4%, you’d have $168,423. What do you think the value would be at 8%? Would it surprise you that you’d have $2,549,825. That’s 15 times more money by simply doubling the rate from 4% to 8% over your lifetime.

The rule of 72 is the kind of principles that enable you to take advantage of The Wealth Wave.

When you borrow money, it works against you! Credit card debt, mortgages, bank loans for your business, student loans, and car loans are all examples of compound interest working against you and working for someone else like the banks.

Here’s how the rule of 72 works:

At 1% rate of return, it takes 72 years for $1 to turn into $2.

At 4%, it takes 18 years for money to double. It’s a simple formula. Now, instead of your money doubling once over your lifetime, you could experience two or three doubles.

At double the rate of return – 8% – it takes half the time, 9 years for money to double. What if your money doubled four or five times in your life?

So if you think that a difference of 1% or 2% won’t amount to much, you’re seriously underestimating the power of compounding, and you’ll pay a huge price.

Do you have any idea how much money in this country is earning less than 1% today? Would you be surprised to hear there is over $11 trillion sitting in savings, money market and cash equivalent accounts as of June 2, 2014… all earning less than 1%? Savings account rates are currently averaging .11% while 1 year CDs average .24% and 5 year CDs average .79%. That means your money will never double in your lifetime. Sucks Ha?

Let’s look at the rule of seventy two this way. At 29 years old, if you had $10,000 earning a 4% rate of return, your money would double in 18 years. You would have $20,000 at age 47.

If you earned 8% rate of return, your money would double in only 9 years. At age 38 you would have $20,000. Lets double it one more time in 9 more years you would have $40,000 at age 47 and one more 9 years $80,000 at age 56. Now you can see the power of the rule of 72 and compounding interest. The more rate of return you earn your money doubles faster.

If you earned 6% on a $10,000 investment, after 36 years, you’ll have $80,000. That’s three doubles in your working lifetime.

If you double your return from 6% to 12% you double every 6 years, it’s not just double the money, it’s actually EIGHT times the money. Your money could double 7 times in your lifetime. At age 65 you will have $640,000 and at age 71 you will have $1,280,000. That’s a lot of doubles you could get over your working lifetime.

The factors that make the Rule of 72 work for you are: time – the interest rate you earn – and how much money you put into the account.

When people don’t have time on their side, they’re faced with doing one of two things – either adding more money or earning a higher interest rate. Generally aiming for higher returns often means increasing risk. So if you don’t want to add risk and you don’t have all the time in the world, what do they have to do? You have to save more money. And reduce the risk and taxation. Take a look at the IUL it might be a perfect fit for you. Read about is an IUL right for you.

Also the rule of seventy two works against you with inflation also. Today we have one of the lowest inflation rates in last 20 years, but if we take the average for the last 20 years of 3.33%, lets round it to just 3% divided by 72 you have 24. So you need to double your income every 24 years to keep up with inflation. Has your income doubled in the last 24 years? If so do you think it will double in the next 24 years? If not you better find a way to add income or you are losing money. That is why I started a business in the financial industry. If you are interested in a part time or full time business in the financial industry watch this video then call me http://wealthwaveinfo.com

When I looked into starting my own business as a financial professional, learning about the Rule of 72 was the BIG A-HA! for me. I can still remember how mesmerized I was – like I had just been handed the skeleton key to the halls of wealth.

It’s a tremendous mental math shortcut to estimate the effect of any growth rate.

The Rule of 72 is so simple and powerful.

Once I’d learned these concepts my financial thinking was changed forever. As I shared this new knowledge with others, I found that it had the same effect on them. I learned that most people you know have never heard of these truths. By giving a financial education, you have the opportunity to help unlock the doors of wealth and prosperity for people you know and care about. This is what drew me into this business and why I love what I do more every day.

Chief Inspiration Officer

Vincent St.Louis

Fighting the forces of Mediocrity

Connect with me on FaceBook HERE

If you found this article on The Rule of 72 useful please comment and share it.

`