IUL is it right for you

Is an IUL right for you?

Is the Indexed Universal Life Insurance the best opportunity?

In this new, challenging economy that calls for innovative wealth-building and retirement strategies, Millennials, Gen-Xers, and Baby Boomers are all trying to find their footing and chart a path for the future. Offering relevant solutions that meet the needs and goals of today’s investors is just as important as the financial education we provide. Let s take a look at a financial option to avoid market risk and build a tax-free income.

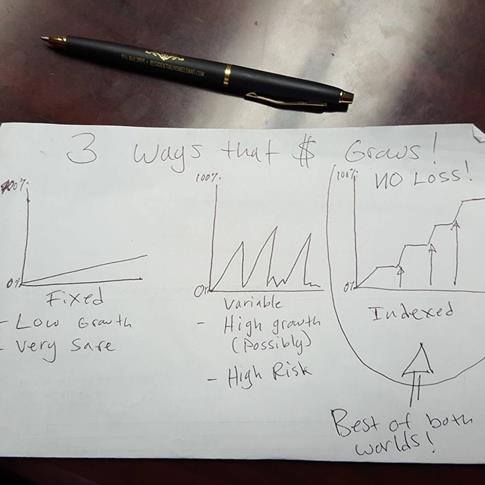

Traditionally, there have been different tracks for saving money. You can choose between a fixed product or a securities product. A fixed account is one in which your principal is guaranteed and today pays between less than 1% to as much as 3%. With securities products, you have a chance for more growth, but you risk your principal. An indexed product is designed to offer the best of both worlds – the chance for more growth without risking your principal.

IUL – Consider the chance for more growth without risking your principal.

Saving, protecting, and growing your money is the key to creating financial security. The concept sounds simple – but achieving that outcome will largely depend on the vehicle you choose to get there. Fixed, securities, and indexed products are all different vehicles. How do you choose the right one for you? And if you’re a financial professional, how do you help your clients choose the right one for them?

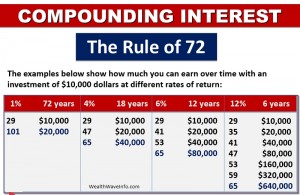

With a lump sum and safety of principle as your driving goal, you could put your money somewhere like a bank account or into some kind of fixed product. That’s the main appeal of a fixed account. So what’s the downside to a fixed strategy? You’re typically not going to get a very high rate of return. We know from the Rule of 72 that a savings account, a bank CD, or a fixed product may not be the smartest avenue to take on your retirement road map.

So what’s an alternative, and hopefully more advantageous path, people can choose? Well, they can consider the stock market and other investment products. The reason we do that is for the upside potential – but what’s the downside? The downside is that you could lose your money. The impact of losses really comes into play when you have your money in the market.

Wouldn’t it be great to discover a way to capture the best of both worlds? What if you found out that you could get upside potential AND safety of principal in one product? That’s what an IUL allow you to do. And that’s one of the primary advantages – or blades if you will – of the indexed Universal Life products, the Swiss Army Knife of Financial Strategies. Loss avoidance with growth potential. You can participate in the market’s gains without putting any of your money at risk.

Indexed life insurance is The Swiss Army Knife of Financial Strategies because this one plan offers four distinct advantages:

- The potential to grow your money with zero market risk.

- An option that can allow you to cover the potentially devastating effects of long-term care needs.

- Allowing you to offset inflation and gain access to tax-free income at retirement.

- And of course, life insurance protection that enables you to leave a tax-free inheritance to your heirs.

And since the only leg of the 3-Legged-Stool of Retirement we truly have control over is the personal savings leg – it’s up to you as an individual to take control of your financial future. I hope I’ve made a compelling case to you that this is one of the strongest strategies you can consider today.

If you’re looking for help setting up an IUL or if you are looking for a career in the financial industry watch this video www.wealthwaveinfo.com

Chief Inspiration Officer

Vincent St.Louis

Fighting the forces of Mediocrity

Connect with me on FaceBook HERE

If you found this article on The Jetstream Box useful please comment and share it.